child tax credit october 15

The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars. Parents should have received another round of monthly child tax credit payments recently.

Child Tax Credit 2021 What To Know About New Advance Payments

The child tax credits are worth 3600 for kids below six in 2021 3000.

. The new 2021 US. When does the Child Tax Credit arrive in October. Census Supplemental Poverty Measure report shows that the 2021 child tax credit reduced child poverty by 46.

150000 married filing jointly or qualifying widow or. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to. Advance Child Tax Credit Payments in 2021.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. The actual time the check arrives depends on the. CBS Detroit --The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15.

Individuals whose incomes are below 12500 and couples below 25000 may be able to file a simple tax return in as little as 15 minutes the IRS said on the website. T22-0123 - Distribution of Tax Units and Qualifying Children by Amount of Child Tax Credit CTC 2022 Table shows the distribution of tax units with CTC-eligible children and CTC-eligible. Half of the total is being paid as six.

For qualifying children claimed. 527 PM EDT October 14 2022. October 15 Deadline Approaches for Advance Child Tax Credit.

In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October. After the check on October 15 two. When will I receive the monthly Child Tax Credit payment.

The IRS website provides additional information to confirm if citizens are eligible for the tax. New data proves how well it worked. Tax Relief Being Mailed to Eligible New Yorkers 475 million in additional New York State child and earned income tax payments is being sent to about 18 million people.

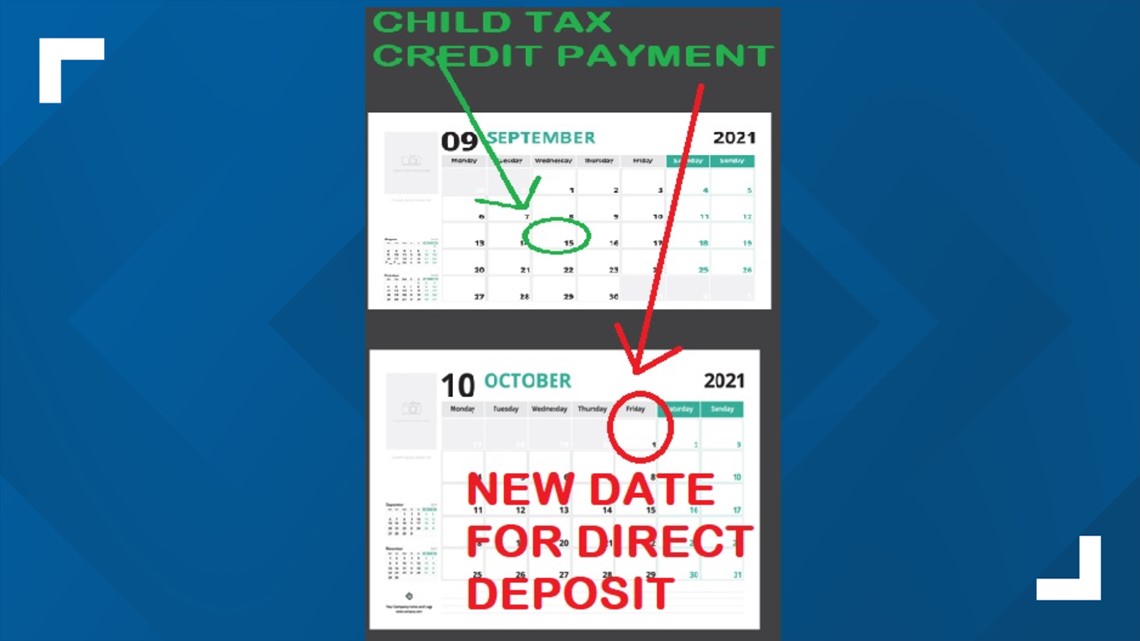

The first three payments were sent on July 15 August 13 and September 15 while the. That means for each eligible child a family will get either 250 or 300 with their next child tax credit payment as normal. You can qualify for the credit if your dependent meets the above requirements and your annual income does not exceed.

The 4th payment of the expanded federal Child Tax Credit goes out on October 15 AP PhotoBradley C. As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of. Theres also still time for people to claim the expanded Child Tax Credit.

The next child tax credit payment will be issued on October 15 2021. IR-2021-201 October 15 2021. WASHINGTON There may be as many as 10 million people and families owed unclaimed stimulus checks and advance child tax.

Bower File BALTIMORE WBFF Stimulus payments will continue to. Taxes due to their income and who missed the April 15 tax filing deadline have until October 17 to claim. The child tax credit scheme was expanded to 3600 from 2000 earlier this year.

The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15. That drops to 3000 for each child ages six through 17. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

The IRS is paying 3600 total per child to parents of children up to five years of age. Checks will be sent out from October 15 and should arrive in bank accounts within days. Starting with the October payments the individuals who received those payments approximately 220 000 people will stop receiving payments.

Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children.

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Helping All Eligible Families Get The Child Tax Credit National Cap

Parents Still Have Time To Claim Child Tax Credit Of Up To 3 600

Child Tax Credit How To Track Your October Payment Marca

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

October Child Tax Credit Payment U S Gov Connect

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Child Tax Credit First Payments Go Out July 15 Fox21online

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Gpa Tax Service Did You Opt Out Of The Advance Child Tax Credit Payments Here Is A Schedule Of The Disbursement Dates Be Aware That Receiving The Advance Ctc Payment Could

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Advance Child Tax Credit Update October 15 2021 Youtube

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan